Payroll work sheet and journal entries LO 2,3 The payroll records of White House Corporation for the

Question:

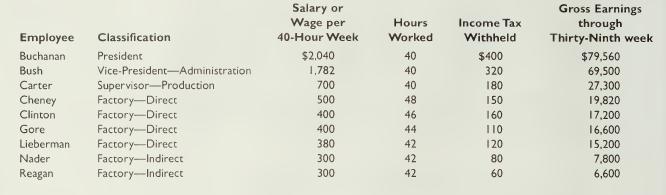

Payroll work sheet and journal entries LO2,3 The payroll records of White House Corporation for the week ending October 7, the fortieth week in the year, show the following:

Required:

1. Complete a work sheet with the following column headings:

Employee 3 columns for Earnings for Week:

Use one for Regular Pay Use one for Overtime Premium Pay (The company pays time-and-a-half for overtime for all employees below the supervisory level.)

Use one for Total for Week Total Earnings through Fortieth Week FICA Taxable Earnings FICA Income Tax Withheld Net Earnings 2. Prepare journal entries for the following:

a. Payroll for fortieth week.

b. Payment of payroll for week.

c. Distribution of the payroll costs, assuming that overtime premium is charged to all jobs worked on during the period.

d. Employer's payroll tax liability.

3. The company carries a disability insurance policy for the employees at a cost of $7.80 per week for each employee. Journalize the employer's cost of insurance premiums for the week.

Step by Step Answer: