Prepare Budgeted Profit Plans for Alternative Market Shares: Barr Food Manufacturing Company produces a variety of consumer

Question:

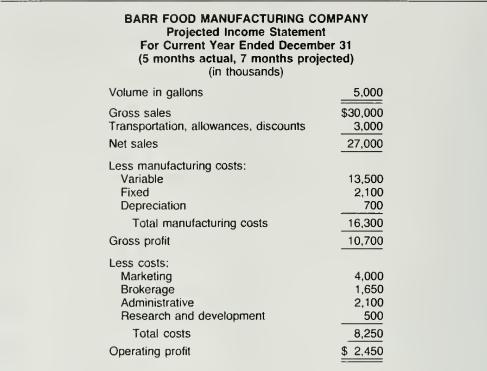

Prepare Budgeted Profit Plans for Alternative Market Shares: Barr Food Manufacturing Company produces a variety of consumer food and spe- cialty products. Current-year data were prepared as shown below for the salad dressing product line, using five months of actual expenses and a seven-month projection. These data were prepared for a preliminary budget meeting for next year between the Specialty Products Division president, marketing vice president, pro- duction vice president, and the controller. The current-year projection was accepted as being accurate, but it was agreed that the operating profit of $2.450.000 was not high enough.

The division president wants a minimum 15 percent increase in gross sales-dollars and a before-tax profit for next year of at least 10 percent of gross sales. He also stated that he would be responsible for a $200,000 reduction in administrative costs to help achieve the profit goal. Both the vice president —marketing and the vice president—production believe the president's objectives will be difficult to achieve. However, they offered the following suggestions to reach the objectives:

1. Sales volume. The current share of the salad dressing market is 15 percent, and the total salad dressing market is expected to grow 5 percent next year. Barr's current market share can be maintained by a marketing expenditure of $4.2 million. The two vice presidents estimate that the market share could be in- creased by additional expenditures for advertising and sales promotion. For an additional expenditure of $525,000, the market share can be raised by 1 percent- age point until the market share reaches 17 percent. To get further market penetration, an additional $875,000 must be spent for each percentage point until the market share reaches 20 percent. Any advertising and promotion expenditures beyond this level are not likely to increase the market share to more than 20 percent.

2. Selling price. The selling price will remain at $6 per gallon. The selling price is closely related to ingredients' costs, which are not expected to change from last year.

3. Variable manufacturing costs. Variable manufacturing costs are projected at 50 percent of net sales (gross sales less transportation, allowances, and discounts).

4. Fixed manufacturing costs. An increase of $100,000 is projected for next year.

5. Depreciation. A projected increase in equipment will increase depreciation by $25,000 in the next year.

6. Transportation, allowances, and discounts. The current rate of 10 percent of gross sales-dollars is expected to remain unchanged.

7. Commission. A rate of 5 percent of gross sales-dollars is projected.

8. Administrative costs. A $200,000 decrease in administrative costs from the current year is projected for next year; this is consistent with the president's commitment.

9. Research and development costs. A 5 percent increase from the current year will be necessary to meet divisional research targets.

Required: The controller must put together a preliminary budget from the facts given. Can the president's objectives be achieved? If so, present the budget that best achieves them. If not, present the budget that most nearly meets the president's objectives.

Step by Step Answer: