Present Value of Cash Flows: Vale University is considering investment in an addition to the campus bookstore

Question:

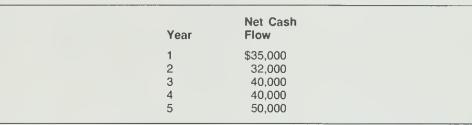

Present Value of Cash Flows: Vale University is considering investment in an addition to the campus bookstore that is expected to return the following cash flows:

This schedule includes all cash flows from the project. The project will require an immediate cash outlay of $130,000. The university is tax exempt, therefore no taxes need be considered.

Required:

a. What is the net present value of the project if the appropriate discount rate is 20 percent?

b. What is the net present value of the project if the appropriate discount rate is 12 percent?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: