Recording the payroll and payroll taxes Using the earnings data developed in E3-1, and assuming that this

Question:

Recording the payroll and payroll taxes Using the earnings data developed in E3-1, and assuming that this was the fiftieth week of employment for Pitt and the previous earnings to date were $99,800, prepare the journal entries for the following:

a. The week's payroll.

b. Payment of the payroll.

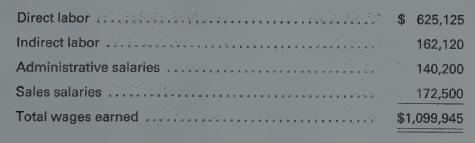

c. The employer's payroll taxes.E3-9 Payroll distribution The total wages and salaries earned by all employees of Clooney Manufacturing Company during the month of March, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows:

a. Prepare a journal entry to distribute the wages earned during March.

b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that two administrative employees with combined earnings this period of $2,000 have exceeded $8,000 in earnings prior to the period?

Step by Step Answer: