Sensitivity Analysis in Capital Investment Decisions: Ames. Inc., is a large marketing company. Management is considering whether

Question:

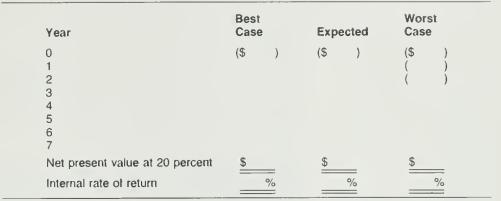

Sensitivity Analysis in Capital Investment Decisions: Ames. Inc., is a large marketing company. Management is considering whether to expand operations by opening a new chain of specialty stores. If the company embarks on this program, cash outlays for inventories, lease rentals, working capital, and other costs are expected to amount to $3.5 million in Year 0. The company expects break-even cash flows in each of Years 1 and 2. Cash flows are expected to increase to $1 million in each of Years 3 and 4, $2 million in Year 5, and $3 million in each of Years 6 and 7.

Management is aware that this is a risky venture because the economy can change over the next few years and consumer tastes could also change. For these reasons, data were obtained on worst case and best case scenarios. In the worst case, cash flows in each of Years 1 and 2 will be minus $500,000. In each of Years 3 through 7. cash flows may only equal $1 million. By contrast, the best case scenario projects positive cash flows of $500,000 in Years 1 and 2. $1.5 million in each of Years 3 and 4. and $4 million in each of Years 5 through 7.

The company's after-tax cost of capital is 20 percent. All cash flows are net of tax.

Required: Complete the following schedule to show the net present values and internal rates of return for this venture for the expected, worst case, and best case scenarios.

Step by Step Answer: