Sensitivity Analysis in Capital Investment Decisions: Research Organization: Boise University is considering establishing a computer technology research

Question:

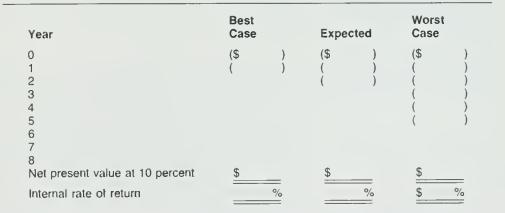

Sensitivity Analysis in Capital Investment Decisions: Research Organization: Boise University is considering establishing a computer technology research center. The research center will require the university to invest $1 million in equipment and facilities. During each of the first two years of operations, the university will incur costs of $150,000 for faculty and staff support. During this period, institute staff will conduct some research and write grants to obtain financial support. If the institute is moderately successful, it will obtain sufficient grant monies to break even in Year 3. After that, the institute expects to operate in such a manner that its cash inflows from grants will exceed its costs by $500,000 per year for Years 4 through 8. Operation of a research institute is quite risky. It is possible that the annual net cash outflows of $150,000 will continue through Year 5. If the institute gets off to this slow a start, it is likely that the positive cash flows will only equal $400,000 in each of Years 6 through 8. On the other hand, university administrators estimate that the institute could break even as early as Year 2 and could receive enough grant money so that cash inflows exceed outflows by $500,000 per year for Years 3 through 8. The university considers that its opportunity cost of funds is 10 percent. As a tax- exempt organization, it incurs no income tax liability.

Required: Complete the following schedule to show the net present values and internal rates of return for this venture for the expected, worst case, and best case scenarios.

Step by Step Answer: