Step Method with Three Service Departments: Oakland Corporation operates two producing departmentspainting and polishingin its automotive refinishing

Question:

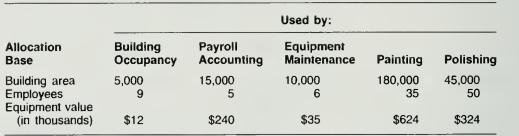

Step Method with Three Service Departments: Oakland Corporation operates two producing departments—painting and polishing—in its automotive refinishing operations. The company has three service departments for its plant: building occupancy, payroll accounting, and equipment maintenance. The accumulated costs in the three service departments were $180,000, $250,000, and $132,000, respectively. The company decided that building occupancy costs should be distributed on the basis of square footage used by each production and service department. The payroll accounting costs are allocated on the basis of number of employees, while equipment maintenance costs are allocated on the basis of the dollar value of the equipment in each department. The use of each basis by all departments during the current period is as follows:

Direct costs of the painting department included $475,000 in direct materials, $650,000 in direct labor, and $225,000 in overhead. In the polishing department, direct costs consisted of $820,000 in direct labor and $145,000 in overhead.

Required:

a. Using the step method, determine the allocated costs and the total costs in each of the two producing departments.

b. Assume 1,000 units were processed through these two departments. What is the unit cost: For painting? For polishing? Total?

Step by Step Answer: