The creation and use of transfer prices The Compressor Division of the General Refrigeration Company makes refrigerator

Question:

The creation and use of transfer prices The Compressor Division of the General Refrigeration Company makes refrigerator compressors that are sold primarily to the Refrigerator Division of the company for use in production of its products. Last year the Compressor Division sold 30 percent of its output to other companies for $55 each. The rest of the production was sold to the Refrigerator Division. Normal marketing and distribution costs for the compressor indus- try average 15 percent of selling price.

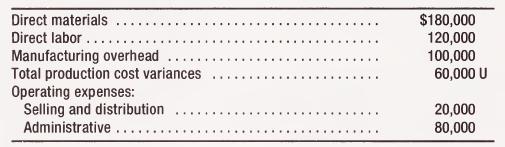

During 1992, the Compressor Division produced 10,000 units with the following total standard costs;

Management expects an 8 percent increase in the market price of the compressors in 1993. Also the standard costs will increase by 10 percent to reflect expected changes in resource costs and a newly negotiated labor contract. With the new standard costs, management of the Com- pressor Division believes the average variance from standard costs will be 4 percent unfavorable. No changes are expected in selling and distribution expenses or administrative expenses. Produc- tion and sales quantities are expected to be the same.

REQUIRED

a. Compute the transfer price based on 1992 standard product cost.

b. Compute the transfer price based on 1992 actual product cost.

c. Compute the transfer price based on 1993 standard product cost.

d. Compute the transfer price based on 1993 expected actual product cost.

e. Compute the transfer price based on 1993 market price.

f. Compute the transfer price based on 1993 market price modified for lower marketing and distribution costs.

g. Compute the transfer price assuming the price provides a 6 percent profit on 1993 expected total costs.

h. Prepare a schedule showing the Compressor Division's net income for each of the 1993 base transfer pricing alternatives.

Step by Step Answer: