Transfer Pricing- Performance Evaluation Issues: The Ajax Division of Gunnco, operating at capacity. has been asked by

Question:

Transfer Pricing- Performance Evaluation Issues: The Ajax Division of Gunnco, operating at capacity. has been asked by the Defco Division of Gunnco Corporation to supply it with electrical fitting No. 1726. Ajax sells this part to its regular customers for $7.50 each. Defco, which is operating at 50 percent capacity, is willing to pay $5 each for the fitting. Defco will put the lifting into a brake unit that it is manufacturing on a cost-plus basis for a commercial airplane manufacturer.

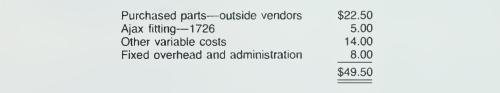

Ajax has a variable cost of producing fitting No. 1726 of $4.25. The cost of the brake unit as built by Defco is as follows

Defco believes the price concession is necessary to get the job. The company uses ROI and dollar profits in the measurement of division and division manager performance.

Required:

a. If you were the division controller of Ajax, would you recommend that Ajax supply fitting 1726 to Defco? (Ignore any income tax issues.) Why or why not?

b. Would it be to the short-run economic advantage of the Gunnco Corporation for the Ajax Division to supply the Defco Division with fitting 1726 at $5 each? (Ignore any income tax issues.) Explain your answer.

c. Discuss the organizational and manager behavior difficulties, if any, inherent in this situation. As the Gunnco controller, what would you advise the Gunnco Corporation president to do in this situation?

Step by Step Answer: