Use of probabilities to estimate profit Vernon Enterprises designs and manufac- tures toys. Past experience indicates that

Question:

Use of probabilities to estimate profit Vernon Enterprises designs and manufac- tures toys. Past experience indicates that the product life cycle of a toy is 3 years. Promotional advertising produces large sales in the early years, but there is a substantial sales decline in the final year of a toy's life.

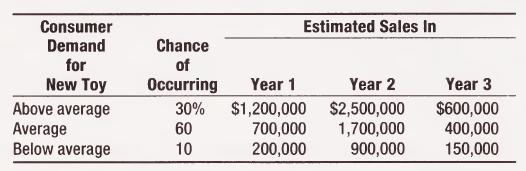

Consumer demand for new toys placed on the market tends to fall into three classes. About 30 percent of the new toys sell well above expectations, 60 percent sell as anticipated and 10 percent have poor consumer acceptance.

A new toy has been developed. The following sales projections were made by carefully evaluating consumer demand for the new toy:

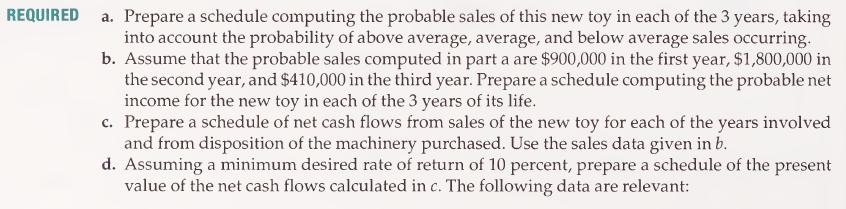

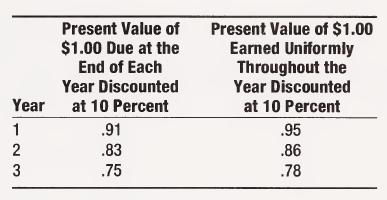

Variable costs are estimated at 30 percent of the selling price. Special machinery must be purchased at a cost of $860,000 and will be installed in an unused portion of the factory that Vernon has unsuccessfully been trying to rent to someone for several years at $50,000 per year and that has no prospects for future utilization. Fixed expenses (excluding depreciation) of a cash flow nature are estimated at $50,000 per year on the new toy. The new machinery will be depreciated by the sum-of-the-years'-digits method with an estimated salvage value of $110,000 and will be sold at the beginning of the fourth year. Advertising and promotional expenses will be incurred uniformly and will total $100,000 the first year, $150,000 the second year, and $50,000 the third year. These expenses will be deducted as incurred for income tax reporting. Vernon believes that state and federal income taxes will total 60 percent of income in the foreseeable future and may be assumed to be paid uniformly over the year income is earned.

Step by Step Answer: