Calculation of fixed and variable overhead rates, normal activity level and under-/ over-recovery of overheads (a) C

Question:

Calculation of fixed and variable overhead rates, normal activity level and under-/

over-recovery of overheads

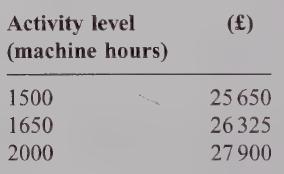

(a) C Ltd is a manufacturing company. In one of the production departments in its main factory a machine hour rate is used for absorbing production overhead. This is established as a predetermined rate, based on normal activity.

The rate that will be used for the period which is just commencing is £15.00 per machine hour. Overhead expenditure anticipated, at a range of activity levels, is as follows:

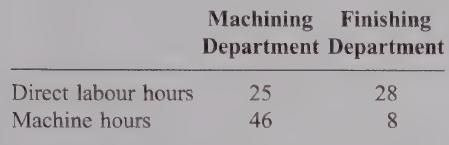

job requires the following machine hours and direct labour hours in the two production departments:

Direct labour in both departments is paid at a basic rate of £4.00 per hour. 10% of the direct labour hours in the finishing department are overtime hours, paid at 125% of basic rate. Overtime premiums are charged to production overhead.

The job requires the manufacture of 189 components.

Each component requires 1.1 kilos of prepared material. Loss on preparation is 10% of unprepared material, which costs £2.35 per kilo.

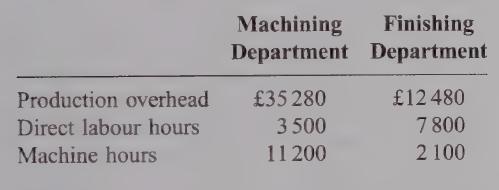

Overhead absorption rates are to be established from the following data:

Required:

(i) Calculate the overhead absorption rate for each department and justify the absorption method used.

(ii) Calculate the cost of the job.

Step by Step Answer: