Computation of three different overhead absorption rates and a cost-plus selling price A manufacturing company has prepared

Question:

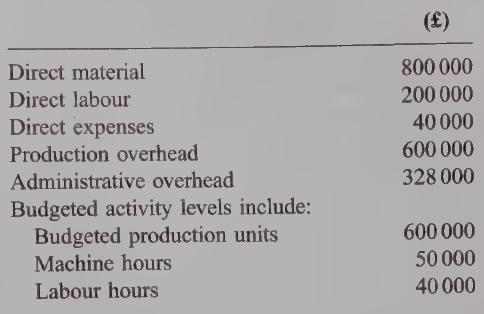

Computation of three different overhead absorption rates and a cost-plus selling price A manufacturing company has prepared the following budgeted information for the forthcoming year:

It has recently spent heavily upon advanced technological machinery and reduced its workforce. AS a consequence it is thinking about changing its basis for overhead absorption from a percentage of direct labour cost to either a machine hour or labour hour basis. The administrative overhead is to be absorbed as a percentage of factory cost.

Required:

(a) Prepare pre-determined overhead absorption rates for production overheads based upon the three different bases for absorption mentioned above. (6 marks)

(b) Outline the reasons for calculating a predetermined overhead absorption rate. (2 marks)

(c) Select the overhead absorption rate that you think the organization should use giving reasons for your decision. (3 marks)

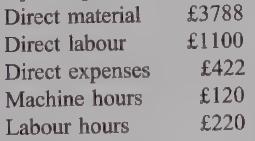

(d) The company has been asked to price job AX, this job requires the following:

Compute the price for this job using the absorption rate selected in

(c) above, given that the company profit margin is equal to 10% of the price. (6 marks)

(ce) The company previously paid its direct labour workers upon a time basis but is now contemplating moving over to an incentive scheme.

Required:

Draft a memo to the Chief Accountant outlining the general characteristics and advantages of employing a successful incentive scheme.

Step by Step Answer: