Overhead analysis sheet and calculation of overhead rates Dunstan Ltd manufactures tents and sleeping bags in three

Question:

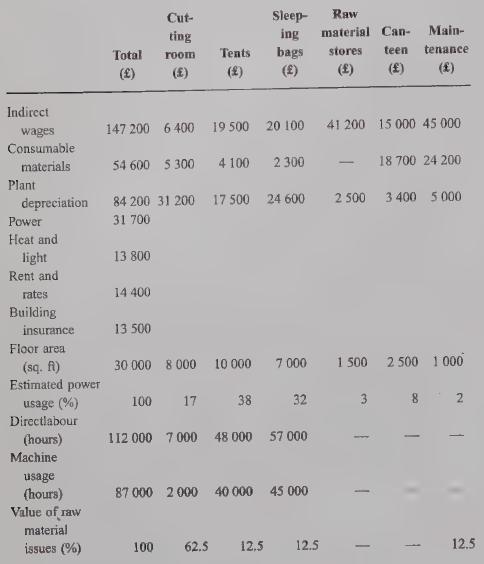

Overhead analysis sheet and calculation of overhead rates Dunstan Ltd manufactures tents and sleeping bags in three separate production departments. The principal manufacturing processes consist of cutting material in the pattern cutting room, and sewing the material in either the tent or the sleeping bag departments. For the year to 31 July cost centre expenses and other relevant information are budgeted as follows:

Requirements:

(a) Prepare in columnar form a statement calculating the overhead absorption rates for each machine hour and each direct labour hour for each of the three production units. You should use bases of apportionment and absorption which you consider most appropriate, and the bases used should be clearly indicated in your statement. (16 marks)

(b) ‘The use of pre-determined overhead absorption rates based on budgets is preferable to the use of absorption rates calculated from historical data available after the end of a financial period.’

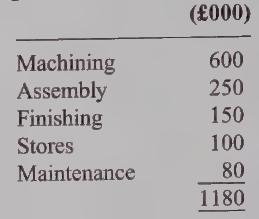

Discuss this statement insofar as it relates to the financial management of a business. and services provided to its customers. It has commenced the preparation of its fixed production overhead cost budget for 2001 and has identified the following costs:

The stores and maintenance departments are production service departments. An analysis of the services they provide indicates that their costs should be apportioned accordingly:

Requirements:

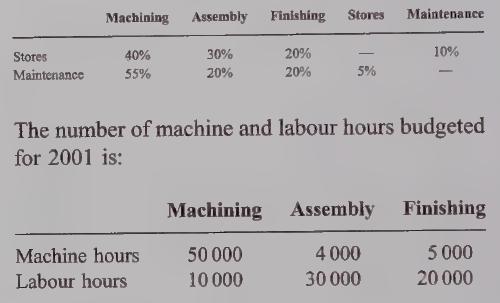

(a) Calculate appropriate overhead absorption rates for each production department for 2001. (9 marks)

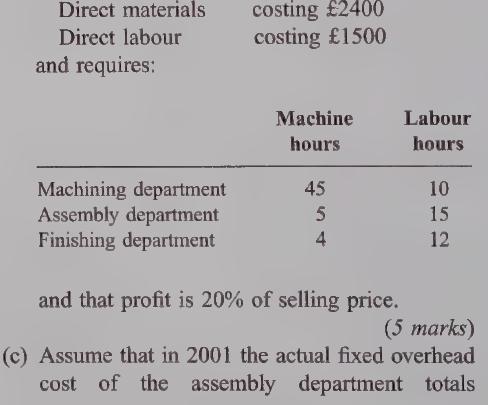

(b) Prepare a quotation for job number XX34, which is to be commenced early in 2001, assuming that it has:

£300000 and that the actual machine hours were 4200 and actual labour hours were 30700.

Prepare the fixed production overhead control account for the assembly department, showing clearly the causes of any over/underabsorption.

(5 marks)

(d) Explain how activity based costing would be used in organizations like DC Limited.

Step by Step Answer: