Equivalent production and preparation of variable and absorption costing profit statements A new subsidiary of a group

Question:

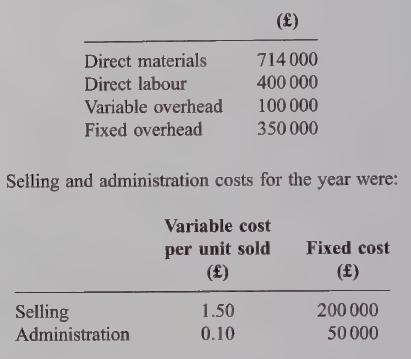

Equivalent production and preparation of variable and absorption costing profit statements A new subsidiary of a group of companies was established for the manufacture and sale of Product X. During the first year of operations 90.000 units were sold at £20 per unit. At the end of the year, the closing stocks were 8000 units in finished goods store and 4000 units in work-in-progress which were complete as regards material content but only half complete in respect of labour and overheads. You are to assume that there were no opening stocks. The work-in-progress account had been debited during the year with the following costs:

The accountant of the subsidiary company had prepared a profit statement on the absorption costing principle which showed a profit of £11 000.

The financial controller of the group, however, had prepared a profit statement on a marginal costing basis which showed a loss. Faced with these two profit statements, the director responsible for this particular subsidiary company is confused.

You are required to

(a) prepare a statement showing the equivalent units produced and the production cost of one unit of Product X by element of cost and in total; (5 marks)

(b) prepare a profit statement on the absorption costing principle which agrees with the company accountant’s statement; (9 marks)

(c) prepare a profit statement on the marginal costing basis; (6 marks)

(d) explain the differences between the two statements given for

(b) and

(c) above to the director in such a way as to eliminate his confusion and state why both statements may be acceptable.

Step by Step Answer: