Preparation of variable and absorption costing profit statements for FIFO and AVECO methods The following information relates

Question:

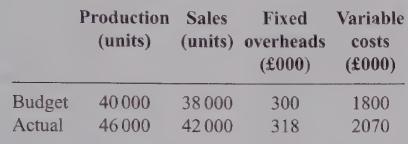

Preparation of variable and absorption costing profit statements for FIFO and AVECO methods The following information relates to product J, for quarter 3, which has just ended:

The selling price of product J was £72 per unit.

The fixed oveheads were absorbed at a predetermined rate per unit.

At the beginning of quarter 3 there was an opening stock of product J of 2000 units, valued at £25 per unit variable costs and £5 per unit fixed overheads.

Required:

(a) (i) Calculate the fixed overhead absorption rate per unit for the last quarter, and present profit statements using FIFO (first in, first out) using:

(ii) absorption costing;

(iii) marginal costing; and (iv) reconcile and explain the difference between the profits or losses. (/2 marks)

(b) Using the same data, present similar statements to those required in part (a). Using the AVECO (average cost) method of valuation, reconcile the profit or loss figures, and comment briefly on the variations between the profits or losses in

(a) and (b). (8 marks)

(Total 20 marks)

ACCA Paper 8 Managerial Finance

Step by Step Answer: