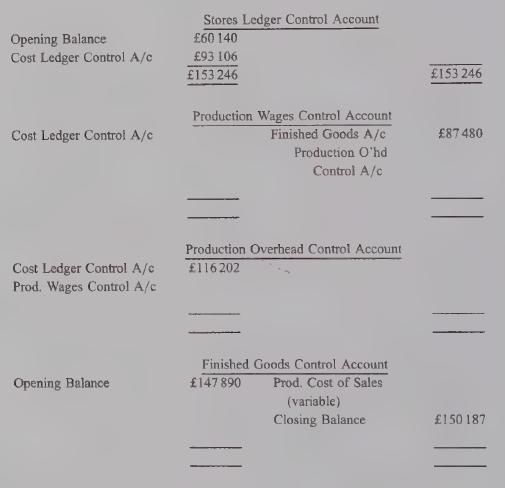

Integrated accounts and computation of the net profit Set out below are incomplete cost accounts for a

Question:

Integrated accounts and computation of the net profit Set out below are incomplete cost accounts for a period for a manufacturing business:

1. Raw materials:

Issues of materials from stores for the period:

Material Y: 1164kg (issued at a periodic weighted average price, calculated to two decimal places of £).

Other materials: £78 520.

No indirect materials are held on the Stores ledger.

Transactions for Material Y in the period:

Opening stock: 540 kg, £7663 Purchases: 1100kg purchased at £14.40 per kg.

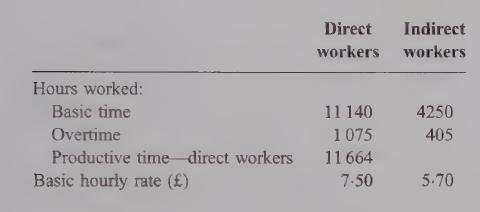

2. Payroll:

Overtime, which is paid at basic rate plus one third, is regularly worked to meet production targets.

3. Production overheads:

The business uses a marginal costing system.

60% of production overheads are fixed costs.

Variable production overhead costs are absorbed at a rate of 70% of actual direct labour.

4. Finished goods:

There is no work in progress at the beginning or end of the period, and a Work in Progress Account is not kept. Direct materials issued, direct labour and production overheads absorbed are transferred to the Finished Goods Control Account.

Required:

(a) Complete the above four accounts for the periods, by listing the missing amounts and descriptions. (13 marks)

(b) Provide an analysis of the indirect labour for the period. (3 marks)

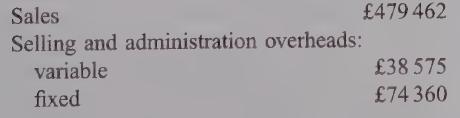

(c) Calculate the contribution and the net profit for the period, based on the cost accounts prepared in

(a) and using the following additional information:

Step by Step Answer: