Preparation of joint product account and a decision on further processing PQR Limited produces two joint productsP

Question:

Preparation of joint product account and a decision on further processing PQR Limited produces two joint products—P and Q — together with a by-product R, from a single main process (process 1). Product P is sold at the point of separation for £5 per kg, whereas product Q is sold for £7 per kg after further processing into product Q2. By-product R is sold without further processing for £1.75 per kg.

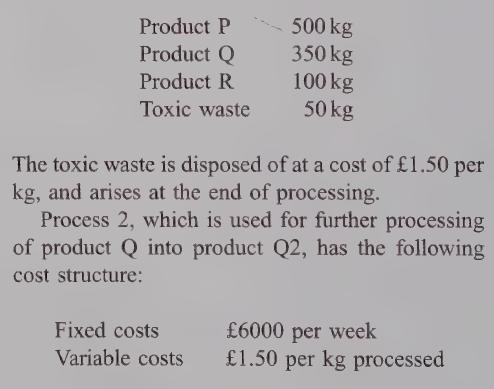

Process 1 is closely monitored by a team of chemists, who planned the output per 1000 kg of input materials to be as follows:

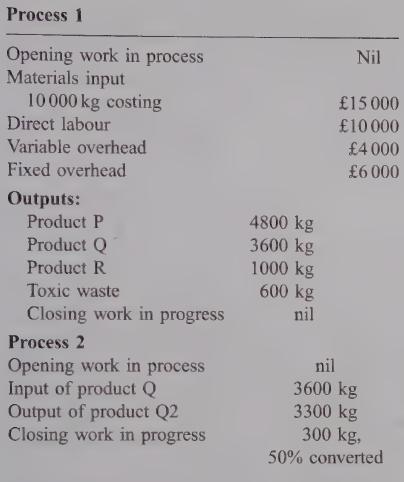

The following actual data relate to the first week of accounting period 10:

Conversion costs were incurred in accordance with the planned cost structure.

Required:

(a) Prepare the main process account for the first week of period 10 using the final sales value method to attribute pre-separation costs to joint products. (12 marks)

(b) Prepare the toxic waste accounts and process 2 account for the first week of period 10.

(9 marks)

(c) Comment on the method used by PQR Limited to attribute pre-separation costs to its joint products. (4 marks)

(d) Advise the management of PQR Limited whether or not, on purely financial grounds, it should continue to process product Q into product Q2:

(i) if product Q could be sold at the point of separation for £4.30 per kg; and (ii) if 60% of the weekly fixed costs of process 2 were avoided by not processing product Q further. (5 marks)

(Total 30 marks)

CIMA Stage 2 Operational Cost Accounting

Step by Step Answer: