Preparation of variable and absorption costing statements and an explanation of the differences in profits Bittern Ltd

Question:

Preparation of variable and absorption costing statements and an explanation of the differences in profits Bittern Ltd manufactures and sells a single product at a unit selling price of £25.

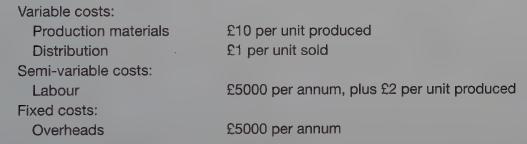

In constant-price-level terms its cost structure is as follows:

For several years Bittern has operated a system of variable costing for management accounting purposes. It has been decided to review the system and to compare it for management accounting purposes with an absorption costing system.

As part of the review, you have been asked to prepare estimates of Bittern’s profits in constant-price-level terms over a three-year period in three different hypothetical situations, and to compare the two types of system generally for management accounting purposes.

(a) In each of the following three sets of hypothetical circumstances, calculate Bittern’s profit in each of years t,, t, and t,, and also in total over the three year period t, to t,, using first a variable costing system and then a full-cost absorption costing system with fixed cost recovery based on a normal production level of 1000 units per annum:

(i) Stable unit levels of production, sales and inventory

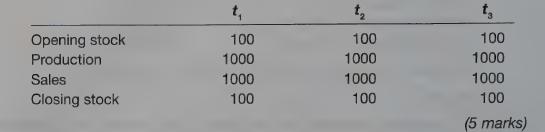

(ii) Stable unit level of sales, but fluctuating unit levels of production and inventory

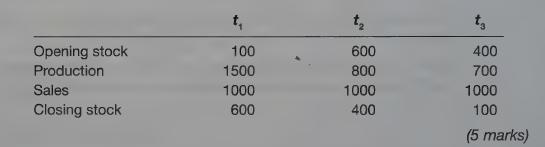

(iii) Stable unit level of production, but fluctuating unit levels of sales and inventory

(Note that all the data in (i)-(iii) are volumes, not values.)

Write a short comparative evaluation of variable and absorption costing systems for management accounting purposes, paying particular attention to profit measurement, and using your answer to

(a) to illustrate your arguments if you wish.

(10 marks)

ICAEW Management Accounting

Step by Step Answer: