SM Ltd makes two products , Exe and Wye. For product costing purposes a single cost centre

Question:

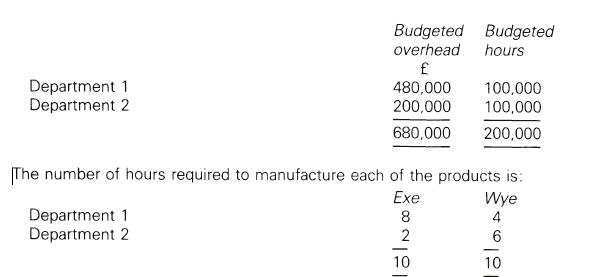

SM Ltd makes two products , Exe and Wye. For product costing purposes a single cost centre overhead rate of £3.40 per hour is used based on budgeted production overhead of £680,000 and 200,000 budgeted hours as shown below ,

There were no work in progress or finished goods stocks at the beginning of the period of operations but at the end of the period 10,000 finished units of Exe and 5,000 finished units of Wye were in stock. There was no closing work in progress.

The prime cost per unit of Exe is £30. The pricing policy is to add 50% to the production cost to cover administration. selling and distribution costs and to provide what is thought to be a reasonable profit.

You are required to:

(a) calculate what the eff ect is on the company's profit for the period, by using a single cost centre overhead rate compared with using departmental overhead rates;

(b) show by means of a comparative statement what the price of Exe would be using:

(i) single cost centre overhead rate; and (ii) departmental overhead rates;

(e) discuss briefly whether the company should change its present policy on overhead absorption. stating reasons to support your conclusion.

Step by Step Answer: