(CMA, STRATEGY) Paste Products manufactures paste for commercial customers that is marketed in ten-gallon metal containers. Always...

Question:

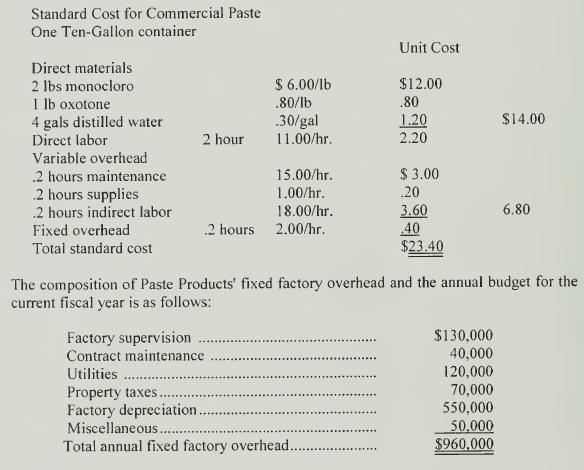

(CMA, STRATEGY) Paste Products manufactures paste for commercial customers that is marketed in ten-gallon metal containers. Always cost conscientious, the firm uses a standard cost system that is revised annually on November 1, the start of the company's fiscal year. Paste Products uses the standard costs to evaluate performance and prepares monthly variance reports for this purpose. The revised standard cost card that has been developed for commercial paste for the 20x6-7 fiscal year is shown below.

All direct materials and indirect supplies are purchased from outside vendors on a two-week production lead time basis. The variable maintenance cost is for maintenance perfonned by Paste Products' employees: contract maintenance is under annual contract with the manufacturers of specific equipment. Depreciation is calculated on the straightline basis. Miscellaneous fixed overhead includes factory insurance and other sundry items.

Variable manufacturing overhead is considered to vary with direct labor hours.

Therefore, Paste Products applies both variable and fixed overhead to production on the basis of direct labor hours. Manufacturing activities and the incurrence of production costs are expected to occur unifonnly throughout the fiscal year.

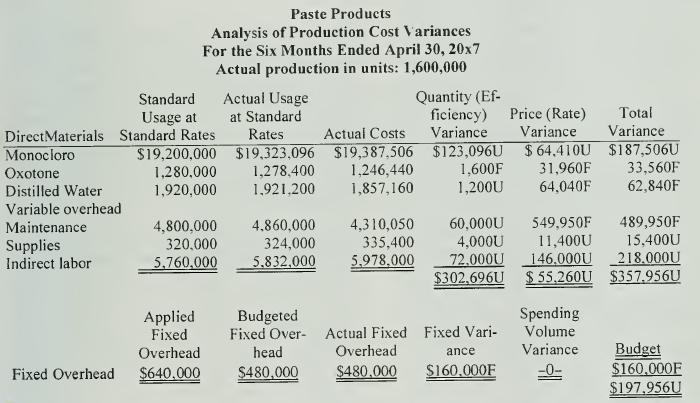

In January 20x7, the company was forced to reduce its sales price from $79.95 per ten-gallon container to $49.95 due to aggressive foreign competition. Although the price reduction resulted in increased sales, the income statement for the first six months revealed dwindling profits. Management immediately mandated a product cost reduction program, and called upon Jill O'Connor, Cost Accountant, to prepare a report specifying target areas for such a program. O'Connor prepared the analysis of production costs shown on the next page to determine if any costs were above standard.

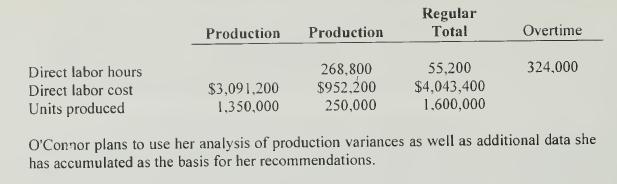

After completing her analysis, O'Connor observed that the net production variances were unfavorable to budget; however, the fixed overhead volume variance partially offset the variable manufacturing variances. She also observed that the direct labor variances ex- ceeded standard by almost 15 percent. Investigating further, she learned that the manu- facturing plant had been working 10 hours per day, six days per week since late January. Workers are paid time-and-one-half for overtime. While she knew that the plant has scheduled overtime, she was not aware of the magnitude. A closer examination of pro- duction records revealed the following facts.

Required:

1. In order to analyze the situation and advise management on the product cost reduction program, Jill O'Connor should determine the number of units Paste Products had planned to produce annually. Calculate the number of units Paster Products had planned to produce during its fiscal year beginning November 1 , 20x6.

2. Jill O'Connor has decided to revise the variance analysis to reflect the impact that overtime had on direct labor production costs.

a. Expand the direct labor variance analysis to reveal as much detail about the direct labor costs as possible from the information provided. This would entail a separate calculation of regular time and overtime variances.

b. Based on your analysis in Requirement B. 1 ., comment on the impact that overtime had on Paste Products direct labor production costs.

1 . Jill O'Connor observed that the fixed overhead volume variance partially offset the variable production variances. She wondered if there would be an advantage to Paste Products of shifting variable costs to fixed costs.

a.Explain the nature of the fixed overhead volume variance.

b. Discuss the advantages and disadvantages of shifting variable costs to fixed costs.

1. Discuss the overall impact that Paste Products' recent change in pricing strategy has had on the company.

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9780070059160

1st Edition

Authors: Edward Blocher, Kung Chen, Thomas Lin