HeadGear, Inc is a small manufacturer of headphones for use In commercial and personal applications. The HeadGear

Question:

HeadGear, Inc is a small manufacturer of headphones for use In commercial and personal applications. The HeadGear headphones are known for their outstanding sound quality and light weight, which makes them highly desirable especially in the commercial market for telemarketing firms and similar communication applications, despite the relatively high price. Although demand has grown steadily, profits have grown much more slowly, and John Hurley, the CEO, suspects productivity is falling, and costs are rising out of hand. John is concemed that the decline in profit growth will affect the stock price of the company and inhibit the finn's efforts to raise new investment capital, which will be needed to continue the fimn's growth. While the firm is now operating at 68% of available production capacity, John thinks the maricet growth will soon exceed available capacity.

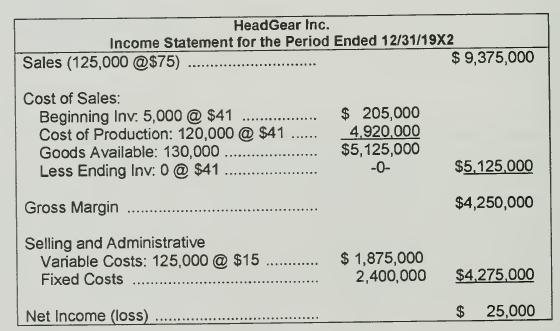

To improve profitability, John has decided to bring in a new COO with the objective of improving profitability very quickly. The new COO understands that profits must be improved within the coming 10-18 months. A bonus of 10% of profit improvement is promised the new COO if this goal is achieved. The following is the income statement for HeadGear for 19X2, from the most recent annual report. Product costs for HeadGear include

$25 per unit variable manufacturing costs and $2,000,000 per year fixed manufacturing overtiead. Budgeted production was 125,000 units in 19X2. Selling and administrative costs include a variable portion of $15 per unit and a fixed portion of $2,400,0000 per year. The same units costs and production level are also applicable for 19X1

The new COO is convinced that the problem is the need to aggressively martlet the product, and that the apparent decline in productivity is really due to underutilization of capacity. The COO increases variable selling costs to $16 per unit and fixed selling costs to $2,750,000 to help achieve this goal. Budgeted sales and production for 19X3 are set ^^

^^^dPu°a^ HrH^uction was 175,000 as planned but sales for 19X3 tumed out to be only 140,000 units, short of the target. The new COO claims that profits have increased considerably, is looking forward to the promised bonus.

REQUIRED:

1. Calculate the absorption cost net income for 19X3, assuming the new selling costs, and that manufacturing costs remain the same as 19X2.

2. Calculate the variable cost net income for 19X3 and explain why it is different from the absorption cost net income.

3. Is the new COO due a bonus? Comment on the effectiveness of Huriey's plan to improve profits by hiring the new COO and promising the bonus.

4. Identify and explain any important ethical issues you see in this case.

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9780070059160

1st Edition

Authors: Edward Blocher, Kung Chen, Thomas Lin