Ranka Company manufacturers high quality leather products. The company's profits have declined during the past nine months.

Question:

Ranka Company manufacturers high quality leather products. The company's profits have declined during the past nine months. Ranl^a has used unit cost data that were developed eighteen months ago in planning and controlling its operations. In an attempt to isolate the causes of poor profit perfomriance, management is investigating the manufacturing operations of each of its products.

One of Ranka's main products is fine leather belts. The belts are produced in a single continuous process in the Bluett Plant. During the process leather strips are sewn, punched, and dyed. Buckles are attached by rivets when the belts are 70 percent complete as to direct labor and overhead (conversion costs). The belts then enter a final finishing stage to conclude the process. Labor and overhead are applied continuously during the process.

The leather belts are inspected twice during the process: (1) right before the buckles are attached (70 percent point in the process) and (2) at the conclusion of the finishing stage (100 percent point in the process). Ranka uses the weighted average method to calculate its unit costs.

The leather belts produced at the Bluett Plant wholesale for $9.95 each. Management wants to compare the current manufacturing costs per unit with the prices which exist on the mari^et for leather belts. Top management has asked the Bluett Plant to submit data on the cost of manufacturing the leather belts for the month of October. This cost data will be used to evaluate whether modifications in the production process should be initiated or whether an increase in the selling price of the belts if justified. The cost per equivalent unit which is being used for planning and controlling purposes is $5.35 per unit.

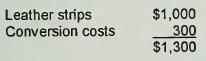

The woric-in-process inventory consisted of 400 partially completed units on October 1 . The belts were 25 percent completed as to conversion costs. The costs included in the inventory on October 1 were as follows:

During October 7,600 leather strips were placed in production. A total of 6,800 good leather belts were completed. A total of 300 belts were identified as defective at the two inspection points—100 at the first inspection point (before buckle is attached) and 200 at the final inspection point (after finishing). This quantity of defective belts was considered normal. In addition, 200 belts were removed from the production line when the process was 40% complete as to conversion costs because they had been damaged as a result of a malfunction during the sewing operation. This malfunction was considered an unusual occurrence, and consequently, the spoilage was classified as abnormal. Defective (spoiled) units are not reprocessed and have zero salvage value. The woriThe costs charged to production during October were as follows:

REQUIRED:

1 .

In order to provide cost data regarding the nnanufacture of leather belts in the Bluett Plant to the top management of Ranka Company, detemnine for the month of October

a. The equivalent units for each factor of production.

b. The cost per equivalent whole unit for each factor of production.

c. The assignment of total production costs to the work-in-process inventory and to goods transferred out.

d. The average unit cost of the 6,800 good leather belts completed and transferred to finished goods.

2. If Ranka Company decided to repair (rework) the 300 defective belts which were considered normal spoilage, explain how the company would account for the rework costs.

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9780070059160

1st Edition

Authors: Edward Blocher, Kung Chen, Thomas Lin