Chapin, Inc., owns a number of food service companies. Two divisions are the Coffee Division and the

Question:

Chapin, Inc., owns a number of food service companies. Two divisions are the Coffee Division and the Donut Shop Division. The Coffee Division purchases and roasts coffee beans for sale to supermarkets and specialty shops. The Donut Shop Division operates a chain of donut shops where the donuts are made on the premises. Coffee is an important item for sale along with the donuts and, to date, has been purchased from the Coffee Division. Company policy permits each manager the freedom to decide whether or not to buy or sell internally. Each divisional manager is evaluated on the basis of return on investment and residual income.

Recently, an outside supplier has offered to sell coffee beans, roasted and ground, to the Donut Shop Division for $4.00 per pound. Since the current price paid to the Coffee Division is $4.50 per pound, Brandi Alzer, the manager of the Donut Shop Division, was interested in the offer. However, before making the decision to switch to the outside supplier, she decided to approach Raymond Jasson, manager of the Coffee Division, to see if he wanted to offer an even better price. If not, then Brandi would buy from the outside supplier.

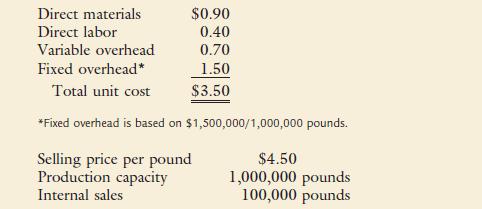

Upon receiving the information from Brandi about the outside offer, Raymond gathered the following information about the coffee:

Required:

1. Suppose that the Coffee Division is producing at capacity and can sell all that it produces to outside customers. How should Raymond respond to Brandi’s request for a lower transfer price? What will be the effect on firmwide profits?

Compute the effect of this response on each division’s profits.

2. Now, assume that the Coffee Division is currently selling 950,000 pounds. If no units are sold internally, total coffee sales will drop to 850,000 pounds. Suppose that Raymond refuses to lower the transfer price from $4.50. Compute the effect on firmwide profits and on each division’s profits.

3. Refer to Requirement 2. What are the minimum and maximum transfer prices?

Suppose that the transfer price is the maximum price less $1. Compute the effect on the firm’s profits and on each division’s profits. Who has benefited from the outside bid?

4. Refer to Requirement 2. Suppose that the Coffee Division has operating assets of $2,000,000. What is divisional ROI based on the current situation? Now, refer to Requirement 3. What will divisional ROI be if the transfer price of the maximum price less $1 is implemented? How will the change in ROI affect Raymond?

What information has he gained as a result of the transfer pricing negotiations?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen