Cost allocation is often the centerpiece of conflict that is resolved in court cases. The litigation usually

Question:

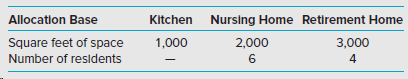

Nursing Care Inc., or NCI, operates both a small nursing home and retirement home. There is a single kitchen used to provide meals to both the nursing home and retirement home, meaning labor costs and utilities costs of the kitchen are shared by the two homes. There is also a centralized cleaning department that provides the cleaning services for both homes as well as the kitchen. The nursing home serves only indigent patients who are on Medicaid. The state Department of Health and Family Services (DHFS) reimburses NCI at Medicaid-approved cost reimbursement rates. The Medicaid reimbursement rates are based on cost information supplied by NCI. The relevant cost and allocation data for the most recent year appear in the following table:

Annual Operating Cost

Cleaning department.................................$ 90,000

Central kitchen..........................................$120,000

Required

1. Management of NCI currently allocates the kitchen and cleaning department costs based on the number of residents in each home. Determine the amount of service department costs assigned to each of the homes using this allocation base. Round percentages to two decimal places in your calculations.

2. DHFS auditors believe the step method of allocation should be used by first assigning cleaning costs based on square feet and then kitchen costs based on number of residents. Determine the amount of service department costs assigned to each of the homes using this allocation method.

3. Provide some comments as to why NCI might prefer its selected allocation method over the one supported by DHFS. Are there ethical implications related to the decision?

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith