Diehlman, Inc., is a pork processor. Its plants, located in the Midwest, produce several products from a

Question:

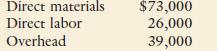

Diehlman, Inc., is a pork processor. Its plants, located in the Midwest, produce several products from a common process: sirloin roasts, chops, spare ribs, and the residual. The roasts, chops, and spare ribs are packaged, branded, and sold to supermarkets. The residual consists of organ meats and leftover pieces that are sold to sausage and hotdog processors. The joint costs for a typical week are as follows:

The revenues from each product are as follows: sirloin roasts, $50,000; chops, $70,000;

spare ribs, $33,000; and residual, $15,000.

Diehlman’s management has learned that certain organ meats are a prized delicacy in Asia. They are considering separating those from the residual and selling them abroad for \($50,000\). This would bring the value of the residual down to \($8,500\). In addition, the organ meats would need to be packaged and then air freighted to Asia. Further processing cost per week is estimated to be \($30,000\) (the cost of renting additional packaging equipment, purchasing materials, and hiring additional direct labor). Transportation cost would be \($7,500\) per week. Finally, resource spending would need to be expanded for other activities as well (purchasing, receiving, and internal shipping). The increase in resource spending for these activities is estimated to be \($2,175\) per week.

Required:

1. What is the gross profit earned by the original mix of products for one week?

2. Should the company separate the organ meats for shipment overseas or continue to sell them at split-off? What is the effect of the decision on weekly gross profit?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen