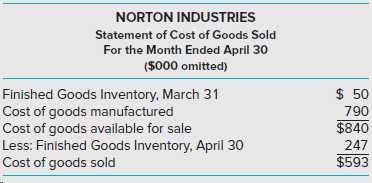

Norton Industries, a manufacturer of cable for the heavy construction industry, closes its books and prepares financial

Question:

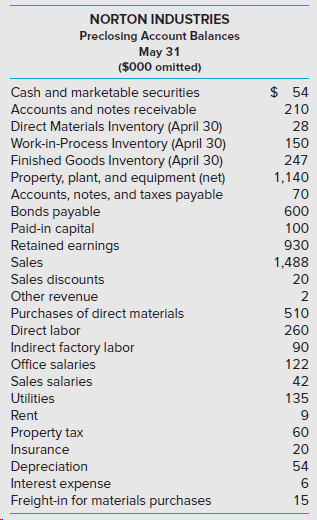

Additional Information

ˆ™ Of the utilities, 80% relates to manufacturing the cable; the remaining 20% relates to the sales and administrative functions.

ˆ™ All rent is for the office building.

ˆ™ Property taxes are assessed on the manufacturing plant.

ˆ™ Of the insurance, 60% is related to manufacturing the cable; the remaining 40% is related to the sales and administrative functions.

ˆ™ Depreciation expense includes the following:

Manufacturing plant.........................$20,000

Manufacturing equipment.................30,000

Office equipment..................................4,000

.............................................................$54,000

ˆ™ The company manufactured 7,825 tons of cable during May.

ˆ™ The inventory balances at May 31, follow:

ˆ™ Materials Inventory $23,000

ˆ™ Work-in-Process Inventory $220,000

ˆ™ Finished Goods Inventory $175,000

Required

Based on Exhibit 3.15A, prepare the following:

1. Statement of cost of goods manufactured for Norton Industries for May.

2. Income statement for Norton Industries for May.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith