Young, Andersen, and Touche (YAT) is a tax services firm. The firm is located in San Diego

Question:

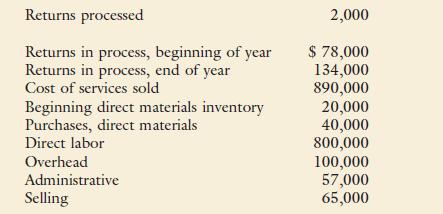

Young, Andersen, and Touche (YAT) is a tax services firm. The firm is located in San Diego and employs 10 professionals and eight staff. The firm does tax work for small businesses and well-to-do individuals. The following data are provided for the last fiscal year. (The Young, Andersen, and Touche fiscal year runs from July 1 through June 30.)

Required:

1. Prepare a statement of cost of services sold.

2. Refer to the statement prepared in Requirement 1. What is the dominant cost?

Will this always be true of service organizations? If not, provide an example of an exception.

3. Assuming that the average fee for processing a return is $700, prepare an income statement for Young, Andersen, and Touche.

4. Discuss three differences between services and tangible products. Calculate the average cost of preparing a tax return for last year. How do the differences between services and tangible products affect the ability of YAT to use the last year’s average cost of preparing a tax return in budgeting the cost of tax return services to be offered next year?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324233100

5th Edition

Authors: Don R. Hansen, Maryanne M. Mowen