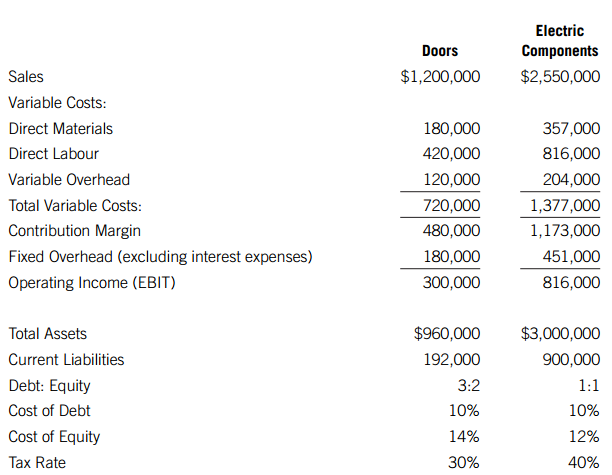

Dubois Garage Doors (DGD) Ltd., has two divisionsDoors and Electronic Components, which operate in a decentralized manner.

Question:

The manager of the Electronic Components has an opportunity to invest in a new machine costing $550,000 with a useful life of 5 years. The new machine will have no residual value at the end of the 5th year. The new machine will be able to reduce the direct materials and direct labour by 10% and variable overhead by 5%. The existing machine was purchased 5 years ago for $450,000, and can last for another 5 years with no residual value in 5 years€™ time. If the new machine is purchased, the existing machine can be sold for $50,000. The new machine will be financed through debt and equity with the same current capital structure, and the same cost of debt and equity in the Electronic Components division.

Required:

A. Calculate each division€™s ROI, RI, and EVA.

B. Calculate the net present value for the new investment project for the Electronic Components division, using the WACC as the discount rate.

C. Calculate the ROI, RI, and EVA for the new investment project, using the WACC for the investment.

D. Based on the calculations from (B) and (D), should DGD proceed with the investment?

E. If you were the manager of the Electronic Components division and your performance evaluation is based ROI, would you proceed with the investment?

F. Recommend a performance evaluation measure that would increase the managers€™ incentives to make decisions that would be in the best interests of DGD.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Step by Step Answer:

Cost Management Measuring, Monitoring And Motivating Performance

ISBN: 1601

3rd Canadian Edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook