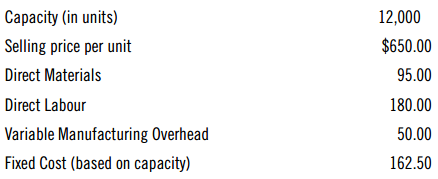

Eason Electronics manufactures wheelchairs. It has two divisionsthe Motors Division located in Canada and the Assembly Division

Question:

The Assembly Division can purchase a similar quality of motors in Japan for $550 each. The Canadian tax rate is 40% and the Japanese tax rate is 30%. The Motors Division currently sells 9,000 units to external customers and 3,000 units to the Assembly Division. The Motors Division uses the variable costing approach (i.e. variable cost + variable cost x 40% mark-up) as the transfer price. One of the Motors Division€™s local customers would like to increase their annual order by 1,000 units. As a result, the Motors Division would like to charge the Assembly Division $650 per unit for 3,000 units to compensate for its loss of 1,000 units of sale from the local customer. The Assembly Division manager was not pleased about the increase in price, and argued that he is willing pay up to his local price of $550 per unit.

Required:

A. Calculate the minimum transfer price, based on Eason€™s transfer price policy.

B. Establish the range for the transfer price, if any, between the two divisions.

C. If you were the CEO of Eason Electronics, which transfer price€”Motors Division€™s external selling price, Motors

Division€™s minimum transfer price, or Assembly Division€™s purchasing price€”should Eason Electronics use to maximize profit and minimize taxes?

D. If the Assembly Division can purchase any quantity from the Motors Division, what is the best course of action for Eason Electronics as a whole? Explain.

Step by Step Answer:

Cost Management Measuring, Monitoring And Motivating Performance

ISBN: 1601

3rd Canadian Edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook