MW Property Management (MW) owns and manages apartment buildings. Each apartment building has a dedicated room for

Question:

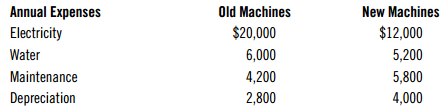

The cost of the old machines was $56,000, and the new machines will cost $40,000. If the new machines are purchased, the old machines can be sold for $3,000 now. Both sets of machines will be disposed of in 10 years, with no residual value then. MW€™s required rate of return is 6%. In general, MW rejects projects with a payback period greater than 4 years.

Required:

A. What is the project€™s payback period?

B. What is the project€™s net present value?

C. What is the project€™s internal rate of return?

D. Suppose you are the manager for this specific building, and your performance appraisal for the current year is based on the accounting income. Would you recommend proceeding with this project to replace the machines?

E. Should MW proceed with this project? Please support your recommendation by providing quantitative and qualitative reasons.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Cost Management Measuring, Monitoring And Motivating Performance

ISBN: 1601

3rd Canadian Edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook