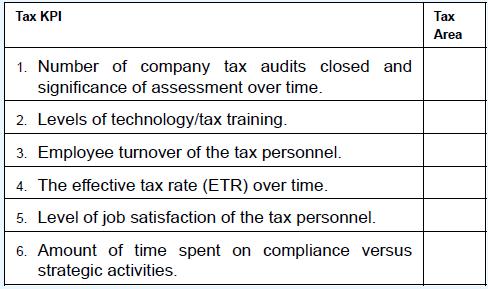

(LO 9-3) Match the following tax KPIs to one of these areas: Tax sustainability Tax efficiency/effectiveness Tax...

Question:

(LO 9-3) Match the following tax KPIs to one of these areas:

Tax sustainability Tax efficiency/effectiveness

Transcribed Image Text:

Tax KPI 1. Number of company tax audits closed and significance of assessment over time. 2. Levels of technology/tax training. 3. Employee turnover of the tax personnel. 4. The effective tax rate (ETR) over time. 5. Level of job satisfaction of the tax personnel. 6. Amount of time spent on compliance versus strategic activities. Tax Area

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Simon kingori

I am a tier-one market researcher and content developer who has been in this field for the last six years. I’ve run the freelancing gamut; from market research, data mining and SEO/SMM to copywriting, Content Development, you name it, I’ve done it. I’m extremely motivated, organized and disciplined – you have to be to work from home. My experience in Freelancing is invaluable- but what makes me a cut above the rest is my passion to deliver quality results to all my clients- it’s important to note, I've never had a dissatisfied client. Backed by a Masters degree in Computer Science from MOI university, I have the required skill set and burning passion and desire to deliver the best results for my clients. This is the reason why I am a cut above the rest. Having taken a Bsc. in computer science and statistics, I deal with all round fields in the IT category. It is a field i enjoy working in as it is dynamic and new things present themselves every day for research and exploration.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

ISE Data Analytics For Accounting

ISBN: 9781265094454

3rd Edition

Authors: Ryan A. Teeter, Vernon Richardson, Katie L. Terrell

Question Posted:

Students also viewed these Business questions

-

Complete a four-year analysis of the company's financial statements (2013-2016) using the FinSAS software. Breville Group Ltd 2013 - 2016 Annual report 2014 Celebrating the 40th Anniversary of the...

-

Complete a four-year analysis of the company's financial statements (2013-2016) using the FinSAS software. Breville Group Ltd 2013 - 2016 Annual report 2014 Celebrating the 40th Anniversary of the...

-

Complete a four-year analysis of the company's financial statements (2013-2016) using the FinSAS software. Breville Group Ltd 2013 - 2016 Annual report 2014 Celebrating the 40th Anniversary of the...

-

Write a program that takes the name of a .wav file and a playback rate r as command-line arguments and plays the file at the given rate. First, use StdAudio.read() to read the file into an array a[]....

-

What are the fundamental prerequisites of a successful wage incentive plan?

-

A flat plate of width 1 m is maintained at a uniform surface temperature of Ts = 150C by using independently controlled, heat-generating rectangular modules of thickness a = 10 mm and length b = 50...

-

(LO 9-3) Match the following tax KPIs to one of these areas: Tax sustainability Tax efficiency/effectiveness Tax KPI 1. Number of company tax audits closed and significance of assessment over time....

-

Vogel, Inc., an S corporation for five years, distributes a tract of land held as an investment to Jamari, its majority shareholder. The land was purchased for $45,000 ten years ago and is currently...

-

With this information what is the Net Working Capital ? Also show current asset and liability accounts in the example please :) Company name Income statement For the Year ended December 31, XXXX...

-

(LO 9-3) Match the following tax KPIs to one of these areas: Tax cost Tax risk Tax KPI 1. Effective tax rate (ETR). 2. Levels of late filing or error penalties and fines. 3. Cash taxes paid. 4....

-

(LO 9-3) Analysis: In your opinion, which of the four general categories of tax KPIs mentioned in the text would be most important to the CEO? Support your opinion.

-

Why is the Federal Reserve Bank of New York granted special status? What is the special status?

-

Operating Leverage Income statements for two different companies in the same industry are as follow Trimax, Inc. Quintex, Inc. Sales $600,000 $600,000 Less: Variable costs 300,000 120,000...

-

Frank and Bob are equal members in Soxy Socks, LLC. When forming the LLC, Frank contributed $40,000 in cash and $40,000 worth of equipment. Frank's adjusted basis in the equipment was $25,000. Bob...

-

May 15th Path of the aginary planet April 22nd o March 21st March H A April 12th April 0 O 55 Mach 1 50 O Altiade 25 110 136 150 170 Ara 190 210 20 250 270 End Whit For how many days was this planet...

-

What is the situational approach based on, how it is different than the others, and when it is best used. what are the strengths and weaknesses of this approach. what is an examples of when each...

-

A rental car manager estimates the number of full-size sedans rented per week so that she can maintain an adequate number of cars in the lot. Data for the past 10 weeks are shown here: Week Rentals...

-

Convert the following Celsius temperatures to Fahrenheit (a) -62.S0C, the lowest temperature ever recorded in North America (February 3, 1947, Snag, Yukon); (b) 56.7C, the highest temperature ever...

-

Don Griffin worked as an accountant at a local accounting firm for five years after graduating from university. Recently, he opened his own accounting practice, which he operates as a corporation....

-

According to the Statements on Standards for Tax Services, what belief should a CPA have before taking a pro-taxpayer position on a tax return?

-

Which IRC sections does Rev. Rul. 2001-29 interpret?

-

The objective is to locate a general overview of available home office deductions. You have previously researched the issue and know that Sec. 280A is the primary authority for this issue. Select the...

Study smarter with the SolutionInn App