An investor has a portfolio consisting of 100 put options on stock A, with a strike price

Question:

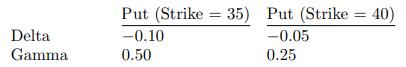

An investor has a portfolio consisting of 100 put options on stock A, with a strike price of 40, and 5 shares of stock A. The investor can write put options on stock A with a strike price of 35. The deltas and gammas of the options are listed below:

Which one of the following actions would delta and gamma neutralize this portfolio?

(A) Write 100 put options with a strike price of 35.

(B) Write 50 put options with a strike price of 35.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: