Assume the Black-Scholes framework. Consider a portfolio consisting of three European options, X, Y, and Z, on

Question:

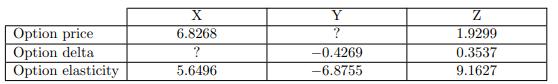

Assume the Black-Scholes framework. Consider a portfolio consisting of three European options, X, Y, and Z, on the same stock. You are given:

Calculate the elasticity of the portfolio.

Transcribed Image Text:

Option price Option delta Option elasticity X 6.8268 5.6496 Y ? -0.4269 -6.8755 Z 1.9299 0.3537 9.1627

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

To calculate the elasticity of the portfolio we need to consider the elasticities and the weights of ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The pressures at the ends of 605m long horizontal pipe flow are 350kPa and 270kPa. The pressure at the point between the ends is 300kPa. The pipe is 305mm in diameter and n=0.018 What is the total...

-

11. Combustion of 1 mole of C6H6(l) inside a closed container of constant volume liberates 900 kJ of heat energy. What would be the value of heat liberated per mole of C6H6(l) if the reaction occurs...

-

Assume that you recently graduated with a major in finance and that you have just landed a job as a financial planner with Barney Smith Inc., a large financial services corporation. Your first...

-

What is the present value of $9,000 received: a. Twenty eight years from today when the interest rate is 10% per year? b. Fourteen years from today when the interest rate is 10% per year? c. Seven...

-

You are the accountant for the South-Western Division of HiValue Grocery Stores. Late in December, Kelly Cholak, the CEO of the Division stops by your office and says I have a couple of questions. I...

-

The controller of Arrowroot Company wishes to improve the companys control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 20X1: June 30,...

-

What are the five basic modes of transportation?

-

The following is an excerpt from a conversation between two sales clerks, Ross Maas and Shu Lyons. Both Ross and Shu are employed by Hawkins Electronics, a locally owned and operated electronics...

-

4. 9 Drs. Glenn Feltham and David Ambrose began operations of their physical therapy clinic, called Northland Physical Therapy, on January 1, 2017. The annual reporting period ends December 31. The...

-

Assume the Black-Scholes framework. For a 3-month 32-strike European straddle on a stock, you are given: (i) The stock currently sells for $30. (ii) The stocks volatility is 30%. (iii) The stock pays...

-

Assume the Black-Scholes framework. Consider a one-year at-the-money European put option on a nondividend-paying stock. You are given: (i) The ratio of the current put option price to the current...

-

Sketch the region bounded by the line y = 2 and the graph of y = sec2 x for /2 < x < /2 and find its area.

-

My current position and some that were prior to this one offer 401K plan benefits and my current position does 100% matching on investment up to six percent I believe. This means that for every six...

-

Kaleen(Pty) Ltd, a Gauteng-based company that sells bottled water, wants to build a storage warehouse in Cape Town to store its products and launch distribution in Cape Town. The storage warehouse...

-

Proponents of this view argue that an unequal distribution of rewards, such as higher incomes or profits, can provide individuals with incentives to work harder, invest, and take risks. The prospect...

-

Do you believe that people should have the right to publicly practice their religion in the workplace environment or should religious practices be separate from the work environment? Why or why not?...

-

Eliminate exhortations ,slogans, and targets for the work force that ask for zero defects and new levels of productivity A poster like "Quality depends on you" is facile and destructive. Management...

-

Assume that A and B are orthogonally similar (Exercise 12). Show that A and B are orthogonally similar.

-

Illini Company, Inc. Balance Sheet as of 12/31/20X0 Assets Current Assets: Cash $1,500,000 Accounts receivable, net 18,000 Inventory 50,000 Total current assets 1,568,000 Equipment 90,000 Goodwill...

-

To repay a $1000 loan, a man paid $91.70 at the end of each month for 12 months. Compute the nominal interest rate he paid.

-

A student bought a $75 used guitar and agreed to pa for it with a single $85 payment at the end of 6 months Assuming semiannual (every 6 months) compounding, what is the nominal annual interest rate?...

-

A firm charges its credit customers 13/4%interest pe month. What is the effective interest rate?

-

Which bankruptcy law gives a firm immediate protection from creditors? A) Chapter 7 B) Chapter 11 C) Chapter 13 D) Chapter 6 Page 10 of 25

-

f. Earnings per share of common stock 9. Price/earnings ratio 2020 2020 2019 2019 au debts and to sell inventory improved or deteri

-

Financial Analysis Report based on financial ratios, horizontal and vertical common size views on IS, and Balance Sheet - Which way do I go in leading to analysis on the overall financial status of a...

Study smarter with the SolutionInn App