Assume you have purchased European put options for 100,000 shares of a nondividend-paying stock and you are

Question:

Assume you have purchased European put options for 100,000 shares of a nondividend-paying stock and you are given the following information.

• Price of stock = $49.16

• Strike price = $50.00

• Continuously compounded risk-free interest rate = 5% per annum

• Volatility = 20% per annum

• There are 20 weeks remaining until maturity.

(a) Determine the initial position you should take in the underlying stock to implement a delta hedging strategy.

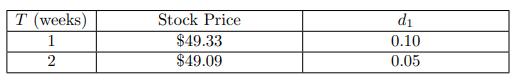

(b) You now have the following information.

You decide to readjust the delta hedging strategy on a weekly basis.

Calculate the cumulative cost, including interest, of the hedge at the end of week 2.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: