On January 1st, 2007, the following currency information is given: Spot exchange rate = $0.82/euro

Question:

On January 1st, 2007, the following currency information is given:

• Spot exchange rate = $0.82/euro

• Dollar interest rate = 5.0% compounded continuously

• Euro interest rate = 2.5% compounded continuously

• Exchange rate volatility = 0.10

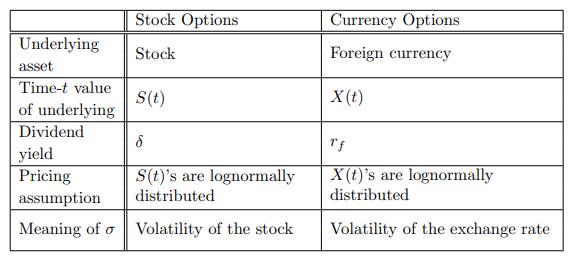

What is the price of 850 dollar-denominated euro call options with a strike exchange rate of $0.80/euro that expire on January 1st, 2008?

(A) Less than $10

(B) At least $10, but less than $20

(C) At least $20, but less than $30

(D) At least $30, but less than $40

(E) At least $40

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: