Once upon a time, Leo entered into three separate positions involving 2-year options on the same stock.

Question:

Once upon a time, Leo entered into three separate positions involving 2-year options on the same stock.

• Option I was a short American-style call with strike price 30.

• Option II was a long Bermuda-style put with strike price 28, where exercise was allowed at any time following an initial 1-year period of put protection.

• Option III was a long European-style put with strike price 20.

At inception, the stock price was 27.

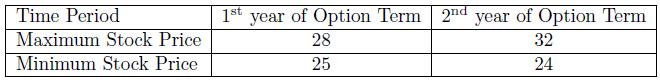

When the options expired, the stock price was 30. The table below gives the maximum and minimum stock price during the 2-year period:

Each option was exercised by its holder at the optimal time. Calculate the sum of the payoffs of the three options.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: