The following one-period binomial stock price model was used to calculate the price of a one-year 10-strike

Question:

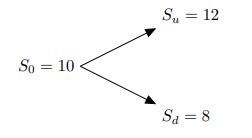

The following one-period binomial stock price model was used to calculate the price of a one-year 10-strike call option on the stock.

You are given:

(i) The period is one year.

(ii) The true probability of an up move is 0.75.

(iii) The stock pays no dividends.

(iv) The price of the one-year 10-strike call is $1.13.

Upon review, the analyst realizes that there was an error in the model construction and that Sd, the value of the stock on a down-move, should have been 6 rather than 8.

The true probability of an up move does not change in the new model, and all other assumptions were correct.

Recalculate the price of the call option.

(A) $1.13

(B) $1.20

(C) $1.33

(D) $1.40

(E) $1.53

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: