You are given the following European and American call options written on the same stock: Rank, as

Question:

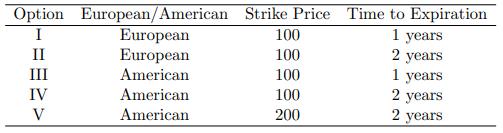

You are given the following European and American call options written on the same stock:

Rank, as far as possible, the prices of these five options.

Transcribed Image Text:

Option I II III IV V European/American European European American American American Strike Price Time to Expiration 1 years 2 years 1 years. 100 100 100 100 200 2 years 2 years

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Based on the information provided in the image the prices of the five European and American call opt...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider European and American call options on the same underlying stock. You are given: (i) Both options have the same strike price of 100. (ii) Both options expire in six months. (iii) The stock...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

What does the Black-Sholes-Merton stock option pricing model assume about the probability distribution of the stock price in one year? What does it assume about the continuously compounded rate of...

-

Assume that you are looking at three perpetuities. Perpetuity 1 (P) has annual cash flows of $850 in Years 1 through infinity (1 - oo) and a present value at Year 0 of $10,119.047619. Perpetuity 2...

-

Evaluate Microsofts strategy in good and poor economic times.

-

Cornelius Company produces women's clothing. During the year, the company incurred the following costs: Factory rent...............................................380000 Direct...

-

8. The concept of partnership dissociation has a technical meaning under the provisions of UPA. Explain the concept.

-

Making a Decision as a Financial Analyst: Preparing and Analyzing a Balance Sheet Your best friend from home writes you a letter about an investment opportunity that has come her way. A company is...

-

5. Farmington Company uses a perpetual inventory system and values its inventory at lower of cost or market. Its accounting records indicate the following information relating to inventory: Inventory...

-

Consider a one-year forward contract whose underlying asset is a coupon paying bond with maturity date beyond the forwards expiration date. Assume the bond pays coupon semi-annually at the coupon...

-

You are given the following European call and put prices on the same stock: All six options have the same expiration date. Propose two sets of arbitrage strategies based on different principles. For...

-

Neither the Ratio Test nor the Root Test helps with p-series. Try them on and show that both tests fail to provide information about convergence. 8 n=1 1

-

How do socio-cognitive mechanisms, such as social identity theory and self-categorization theory, contribute to the formation and maintenance of organizational culture ?

-

How do you Sales Forecast and an Expense forecast for future years?

-

2. Do you really think the Bono case described in Ch. 2 is a genuine ethical conflict? Explain. 6. Describe the ethical issue in the Siemens case

-

How do I calculate using the SPC method if my key metric is time

-

Labor Standards: Where Do They Belong on the International Trade Agenda? Author(s): Drusilla K. Brown Link. https://viu.summon.serialssolutions.com/?#!/search?....

-

Let y = y(x) = x - x3 / 3! + x5 / 5! - x7 / 7! + .... Show that y satisfies that differential equation y" + y = 0 with the conditions y(0) = 0 and y'(0) = 1. From this guess a simple formula for y?

-

One hundred pounds of water at atmospheric pressure are heated from 60F to 200F. What is the enthalpy change? The internal energy change? Why is the difference between the internal energy change and...

-

a. Use a spreadsheet (or a calculator with a linear regression function) to determine Stock X's beta coefficient. b. Determine the arithmetic average rates of return for Stock X and the NYSE over the...

-

You are given the following set of data: Construct a scatter diagram showing the relationship between returns on Stock Y and the market. Use a spreadsheet or a calculator with a linear regression...

-

The beta coefficient of an asset can be expressed as a function of the asset's correlation with the market as follows: a. Substitute this expression for beta into the Security Market Line (SML),...

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App