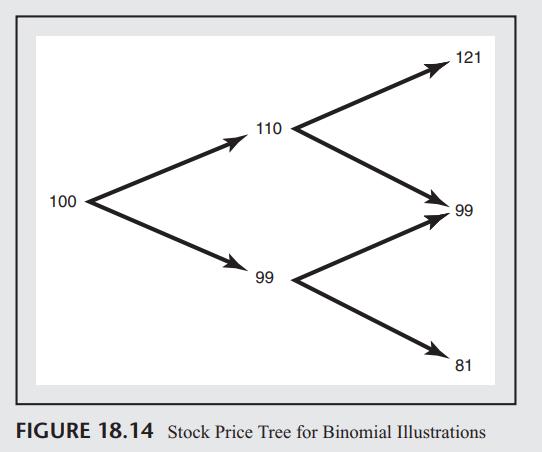

Consider the binomial tree of Figure 18.14. Suppose that the per-period interest rate is R = 1.02.

Question:

Consider the binomial tree of Figure 18.14. Suppose that the per-period interest rate is R = 1.02.

(a) Show that the price of a call on a put in this model with a strike of k = 4 and a maturity of one period is 1.58, where the underlying put has a strike of 100 and a maturity of 2 periods.

(b) Show that the delta of the call on the put in the binomial example is −0.202. (Use the usual formula for a binomial delta.)

(c) Verify that a position consisting of a short position in the option and a short position in 0.202 units of the stock is perfectly riskless over the compound option’s one-period life.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: