Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 5th March 2011 the management of Mat Hill Limited decided to forfeit 200,000 ordinary shares from a defaulting shareholder who had subscribed to

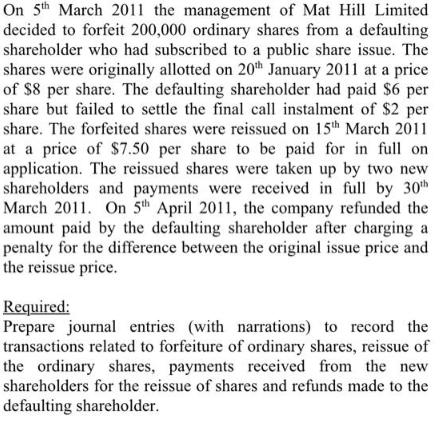

On 5th March 2011 the management of Mat Hill Limited decided to forfeit 200,000 ordinary shares from a defaulting shareholder who had subscribed to a public share issue. The shares were originally allotted on 20th January 2011 at a price of $8 per share. The defaulting shareholder had paid $6 per share but failed to settle the final call instalment of $2 per share. The forfeited shares were reissued on 15th March 2011 at a price of $7.50 per share to be paid for in full on application. The reissued shares were taken up by two new shareholders and payments were received in full by 30th March 2011. On 5th April 2011, the company refunded the amount paid by the defaulting shareholder after charging a penalty for the difference between the original issue price and the reissue price. Required: Prepare journal entries (with narrations) to record the transactions related to forfeiture of ordinary shares, reissue of the ordinary shares, payments received from the new shareholders for the reissue of shares and refunds made to the defaulting shareholder.

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 If the shares were issued at Par Particu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started