Question

Rekall Inc., the memory implant company, has 7 million shares of common stock outstanding and 100,000 semi-annual bonds. The bonds have 6 years to

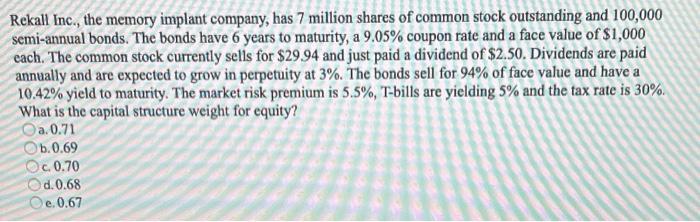

Rekall Inc., the memory implant company, has 7 million shares of common stock outstanding and 100,000 semi-annual bonds. The bonds have 6 years to maturity, a 9.05% coupon rate and a face value of $1,000 each. The common stock currently sells for $29.94 and just paid a dividend of $2.50. Dividends are paid annually and are expected to grow in perpetuity at 3%. The bonds sell for 94% of face value and have a 10.42% yield to maturity. The market risk premium is 5.5%, T-bills are yielding 5% and the tax rate is 30%. What is the capital structure weight for equity? Oa.0.71 Ob.0.69 Oc.0.70 Od.0.68 Oe.0.67

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Total value of Common stock700000029...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

12th edition

978-0133075403, 133075354, 9780133423938, 133075400, 013342393X, 978-0133075359

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App