On December 1, the S&P 500 index (SPX) is trading at 1396.71. The prices of call options

Question:

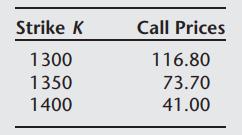

On December 1, the S&P 500 index (SPX) is trading at 1396.71. The prices of call options on the index expiring on March 16 (i.e., in a bit over three months) are as follows:

Assuming the interest rate for that period is 4.88% and the annual dividend rate on the SPX is 1.5%, compute the implied volatility for each of the SPX options using the Black-Scholes formula. Are these volatilities the same? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: