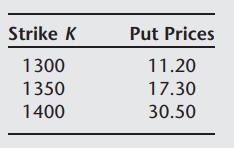

(Repeat for puts) On December 1, the S&P 500 index (SPX) is trading at 1396.71. The prices...

Question:

(Repeat for puts) On December 1, the S&P 500 index (SPX) is trading at 1396.71. The prices of put options on the index expiring on March 16 (i.e., a little over three months) are as follows:

Assuming the interest rate for that period is 4.88%, and the annual dividend rate on the SPX is 1.5%, compute the implied volatility for each of the options using the BlackScholes formula. Are these volatilities the same? Explain. Also, are these volatilities the same as that obtained from the previous question? Should they be? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: