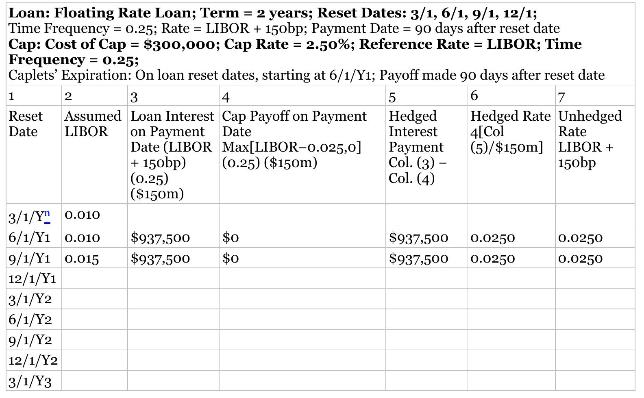

Suppose Eastern Bank offers Gulf Refinery a ($ 150) million floating-rate loan along with a cap to

Question:

Suppose Eastern Bank offers Gulf Refinery a \(\$ 150\) million floating-rate loan along with a cap to finance the purchase of its drilling equipment. The floating-rate loan has a maturity of two years, starts on December 20, and is reset the next seven quarters. The initial quarterly rate is equal to \(2.5 \% / 4\) and the other rates are reset quarterly to equal to one fourth of the annual LIBOR on those dates plus 150 basis points: (LIBOR \% +1.5\%)/4. The cap Eastern Bank is offering Gulf has the following terms:

- Seven caplets with expiration dates of 3/20, 6/20, and 9/20.

- The cap rate on each caplet is \(2.5 \%\).

- The time period for each caplet is 0.25 per year.

- The payoffs for each caplet are at the interest payment dates of the loan.

- The reference rate is the LIBOR.

- Notional principal is \(\$ 150\) million.

- The cost of the cap is \(\$ 300,000\).

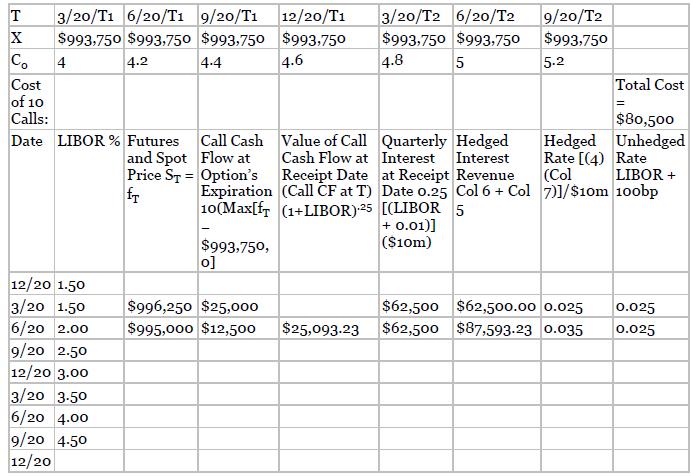

TABLE 8.2

Complete Table 8.3, showing the company’s quarterly interest payments, caplet cash flows, hedged interest payments (interest minus caplet cash flow), and hedged and unhedged rate as a proportionof a \($150\) million loan (do not include cap cost) for each period, given LIBOR rates starting at 1% on3/1/Y1 and then increasing each period by 50 bp.

Table 8.3.

Step by Step Answer: