Northern Trust is considering setting a floor on a two-year ($ 10) million investment in a floating-rate

Question:

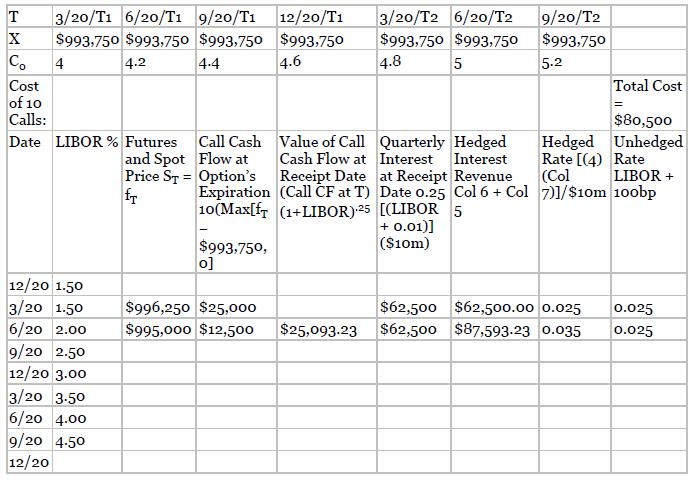

Northern Trust is considering setting a floor on a two-year \(\$ 10\) million investment in a floating-rate note (FRN) from First National Bank with a strip of Eurodollar calls. The FRN pays LIBOR plus 100 basis points, starts on December 20 with the initial quarterly rate equal to \(3.5 \% / 4\) and the other rates reset each quarter on \(3 / 20,6 / 20,9 / 20\), and 12/20 over the next seven quarters to equal to one fourth of the annual LIBOR on those dates plus 100 basis points: (LIBOR \(\%+1 \%\) ) \(/ 4\). The top panel in Table 8.2 shows on December 20 seven Eurodollar futures call contracts with expirations coinciding with First National Bank's FRN and their premium on December 20.

The exercise price on each call is \(\$ 993,750\) ( \(X=98.5\) CME index).

a. Explain how the Northern Trust could attain a floor on its floating-rate note with the call options shown in Table 8.2. What is the cost of the call strip?

b. Complete Table 8.2, showing Northern Trust's quarterly interest receipt, option cash flow, hedged interest receipt (interest plus option cash flow), and hedged rate as a proportion of a \(\$ 10\) million investment (do not include option cost) for each period, given the LIBOR rates shown in the table.

Table 8.2

Step by Step Answer: