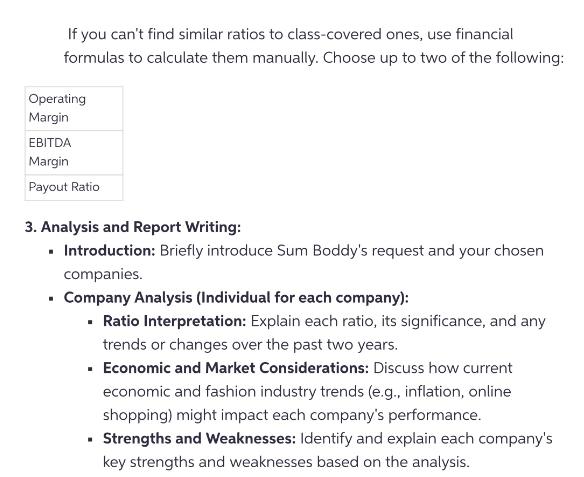

If you can't find similar ratios to class-covered ones, use financial formulas to calculate them manually. Choose up to two of the following: Operating

If you can't find similar ratios to class-covered ones, use financial formulas to calculate them manually. Choose up to two of the following: Operating Margin EBITDA Margin Payout Ratio 3. Analysis and Report Writing: Introduction: Briefly introduce Sum Boddy's request and your chosen companies. Company Analysis (Individual for each company): Ratio Interpretation: Explain each ratio, its significance, and any trends or changes over the past two years. Economic and Market Considerations: Discuss how current economic and fashion industry trends (e.g., inflation, online shopping) might impact each company's performance. Strengths and Weaknesses: Identify and explain each company's key strengths and weaknesses based on the analysis. . Comparison and Recommendation: . Comparative Analysis: Directly compare the two companies' performance and highlight key differences based on the ratios and additional factors. Investment Recommendation: Based on your analysis, recommend which company is a better investment for Sum Boddy, providing clear justification for your choice. Explanation: Calculate additional ratios (optional), analyze each company's financials, discuss economic/market impact, and compare to recommend the best investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Introduction Sum Boddy has requested an analysis of two companies ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started