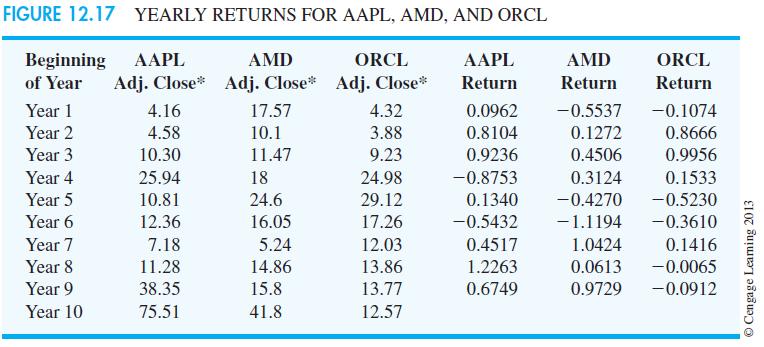

Question: Formulate and solve the Markowitz portfolio optimization model that was introduced in Problem 18 using the return data in columns five, six, and seven of

Formulate and solve the Markowitz portfolio optimization model that was introduced in Problem 18 using the return data in columns five, six, and seven of Figure 12.17. In this case, nine scenarios correspond to the yearly returns for years 1 through 9. Treat each scenario as being equally likely.

Figure 12.17:

for constructing the portfolio should be similar to the one developed for Hauck Financial Services in Section 12.5.

for constructing the portfolio should be similar to the one developed for Hauck Financial Services in Section 12.5.

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

To formulate and solve the Markowitz portfolio optimization model follow these steps Step 1 Calculat... View full answer

Get step-by-step solutions from verified subject matter experts