15.2 Macroeconomists have also noticed that interest rates change following oil price jumps. Let Rt denote the

Question:

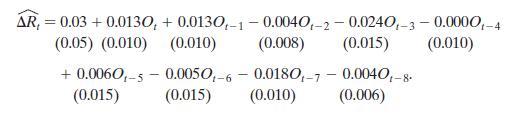

15.2 Macroeconomists have also noticed that interest rates change following oil price jumps. Let Rt denote the interest rate on 3-month Treasury bills (in percentage points at an annual rate). The distributed lag regression relating the change in Rt (Rt) to Ot estimated over 1960:Q1–2013:Q4 is

a. Suppose that oil prices jump 25% above their previous peak value and stay at this new higher level (so that Ot = 25 and Ot + 1 = Ot + 2 = g= 0) . What is the predicted change in interest rates for each quarter over the next 2 years?

b. Construct 95% confidence intervals for your answers to (a).

c. What is the effect of this change in oil prices on the level of interest rates in period t + 8? How is your answer related to the cumulative multiplier?

d. The HAC F-statistic testing whether the coefficients on Ot and its lags are zero is 1.93. Are the coefficients significantly different from zero?

Step by Step Answer:

Introduction To Econometrics

ISBN: 9781292071367

3rd Global Edition

Authors: James Stock, Mark Watson