The forward market is efficient if the lagged forward rate is an unbiased predictor of the current

Question:

The forward market is efficient if the lagged forward rate is an unbiased predictor of the current spot rate.

(a) Estimate the following model of the spot and the lagged 1-month forward rate

\[

\mathrm{s}_{t}=\beta_{0}+\beta_{1} \mathrm{f}_{t-4}+u_{t}

\]

where the forward rate is lagged four periods (the data are weekly). Verify that weekly data on the \$/AUD spot exchange rate and the 1 month forward rate yields

\[

s_{t}=0.066+0.916 f_{t-4}+e_{t}

\]

where a lag length of four is chosen as the data are weekly and the forward contract matures in one month. Test the restriction \(\beta_{1}=1\) and interpret the result.

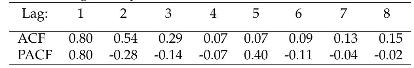

(b) Compute the ACF and PACF of the least squares residuals, \(e_{t}\), for the first 8 lags. Verify that the results are as follows.

(c) There is evidence to suggest that the ACF decays quickly after 3 lags. Interpret this result and use this information to improve the specification of the model and redo the test of \(\beta_{1}=1\).

(d) Repeat parts (a) to (c) for the 3-month and the 6-month forward rates.

Step by Step Answer:

Financial Econometric Modeling

ISBN: 9781633844605

1st Edition

Authors: Stan Hurn, Vance L. Martin, Jun Yu, Peter C.B. Phillips