Consider a borrowing household with disposable income x after purchasing necessities; this amount comes from outside sources,

Question:

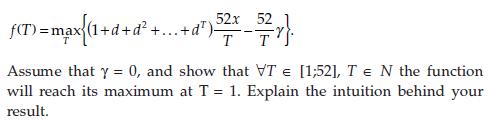

Consider a borrowing household with disposable income x after purchasing necessities; this amount comes from outside sources, not from the investment that the household is seeking microfinance funding to support. This outside income is received each week, but it decays at a rate given by the discount factor d per period. For example, if the outside income is not committed to the loan repayments, it gets diverted into miscellaneous consumption expenses with probability (1 - d) every week. We assume that these expenses bring the household no utility (but this can be relaxed while still making the argument). The bank must decide how many installments (n = 52/T) to ask for the loan.

If the loan is a year in duration, installments may be one time (n = 1, T = 52), monthly (n = 12, T = 52/12) or weekly (n = 52, T = 1), etc. The principal and interest to be repaid sums to the amount L, and the transaction costs associated with such installment is g. The transaction cost is borne by the borrower. Assuming linear preferences with respect to income, and assuming that the loan size is no larger than the outside revenues that can be secured to repay the bank, the borrower will chose the frequency of installments T to maximize the size of its loan. This is its expected total payment to the bank minus its total transaction cost:

Step by Step Answer:

The Economics Of Microfinance

ISBN: 978-0262513982

2nd Edition

Authors: Beatriz Armendariz ,jonathan Morduch